Quantitative vs. Qualitative Adjustments

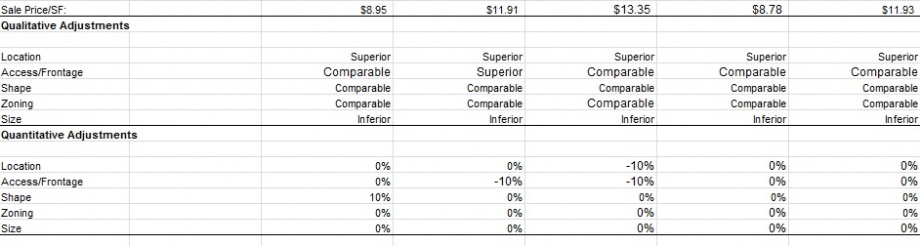

Since two properties are usually not identical, especially in commercial real estate, it is essential for an appraiser to make adjustments within the Sales Comparison Approach. The adjustments made by the appraiser should imitate the market. For example, adjustments could include location, size, and topography for a property, if these are characteristics that the average buyer in the market would consider when making a purchase. Appraisers can use either quantitative or qualitative adjustments (or a combination of both). Generally, quantitative adjustments consist of making either percentage or dollar adjustments to account for the differences between the subject and the comparable sales. Qualitative adjustments require the appraiser to rank the comparable sales in terms of inferiority/superiority to the subject. Each of these techniques has its own weaknesses and strengths.

Quantitative adjustments are considered useful because they provide an actual quantifiable and measurable adjustment. Since the adjustment is quantified, it is more objective in nature than a qualitative adjustment. The result is a more scientific and precise analysis of the comparable data. However, the major weakness of the quantifiable adjustment is that it is rare to find the data to support quantitative adjustments. For example, the most common way to find a quantitative adjustment is to use a paired data analysis. In this analysis, two properties are compared two each other that are similar in all their attributes besides the one difference being analyzed. An example would be two lots that are identical except that one lot is a corner lot while the other is an interior lot. If the corner lot is $10,000 and the interior lot is $8,000, the appraiser could conclude a corner lot adjustment of $2,000, or 25%. The problem is that there is not typically enough data to provide paired sales for all the required adjustments for the subject property.

On the other hand, the biggest weakness of qualitative adjustments is that they are more subjective in nature because they do not include direct quantification. However, their biggest strength is that they match the typical behavior of most market participants. It is often more common for the typical buyer to compare property attributes on a scale of superior or inferior than to calculate market-derived adjustment factors. Both types of adjustments have their own strengths and weaknesses and when determining the applicability of using quantitative or qualitative adjustments the appraiser needs to consider the dependability of the market data in support of an adjustment and how market participants would make similar adjustments. Due to the imperfect nature of the real estate market, the judgment and experience of the appraiser is always a factor in determining what type of adjustments to use.