Half Sized Blog Element (Single Author Style)

Half Sized Blog Element (Multi Author Style)

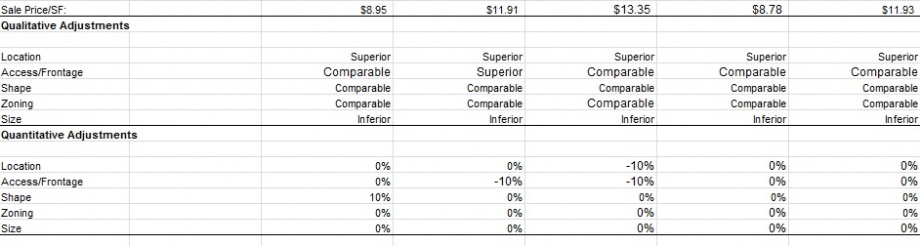

Quantitative vs. Qualitative Adjustments

in Commercial Appraisal[types field=’full_body’][/types]

The Unfinished Office Park

in Commercial Appraisal[types field=’full_body’][/types]

Quantitative vs. Qualitative Adjustments

in Commercial Appraisal[types field=’full_body’][/types]

The Unfinished Office Park

in Commercial Appraisal[types field=’full_body’][/types]