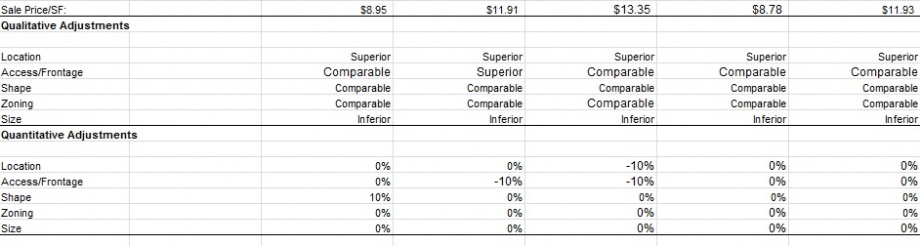

Quantitative vs. Qualitative Adjustments

Since two properties are usually not identical, especially in commercial real estate, it is essential for an appraiser to make adjustments within the Sales Comparison Approach. The adjustments made by the appraiser should imitate the market.…

The Unfinished Office Park

Almost every larger town has one - the unfinished development project that was put to a halt during the economic recession. As the bottom fell out of the market, developers were caught with half-finished projects and a falling demand for commercial…

The Religious Facility Appraisal – Part IV

In our fourth and final segment of The Religious Facility Appraisal series we will look at the reliability of using the Income Approach in the valuation of Religious Facilities. Religious facilities are not frequently leased on the open market,…

The Religious Facility Appraisal – Part III

In our third segment of The Religious Facility Appraisal series we will take a look at the most common value approach used for religious facilities, The Cost Approach. Due to the fact that religious facilities are special-use properties,…

The Religious Facility Appraisal – Part II

In our second segment of The Religious Facility Appraisal we will take a look at several things that need to be considered when using The Sales Comparison Approach in the valuation of a religious facility. The development of the Sales Comparison…

The Religious Facility Appraisal – Part I

Individuals and congregations have many reasons why they may need an appraisal of a religious facility including new construction, financing, a potential sale or purchase, insurance purposes, or asset valuation tied to a number of financial…

Florida State Homes Article

Chris Rolly of Commercial Investment Appraisers was featured in an article with Florida State Homes. Check out the link below for the full interview.

http://www.floridastatehomes.com/articles/interview-with-chris-rolly

http://www.floridastatehomes.com">Florida…

A common mistake – What to do with “extra” land

Improperly handling excess and surplus land is a common mistake among inexperienced appraisers. When a property has “extra” land that is not required to accommodate the subject improvements, it is important to identify whether then land…

Commercial Appraisal Report Format Changes For 2014

The Appraisal Standards Board, which develops, interprets, and amends the Uniform Standards of Professional Appraisal and Practice (USPAP), has adopted a revision for the 2014-2015 USPAP that will reduce the number of narrative report options…