Estimating Capitalization Rates – Part III

In the first two parts of this series, we have introduced and defined four different methods of estimating capitalization rates. In this part of the series, we will take a detailed look at market-derivation methods and the factors that should be considered when extracting market-derived capitalization rates. As has already been discussed in the previous two installments of the series, market derivation is the most reliable and applicable approach in most cases. The band of investment and debt coverage ratio methods are the next best options, and the investor survey method can be a reliable check for the other methods.

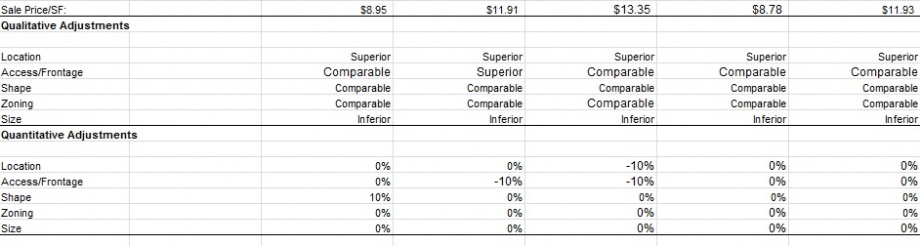

The market derivation method is important because it is closely tied to market activity and it can easily be understood my market participants. It provides the best insight into how investors in the subject’s unique market are actually making decisions. Most of the drawbacks of a market derived capitalization rate occur when the appraiser does not consider that these rates are being extracted from comparable properties. The comparable sale that the capitalization rate is being extracted from should share similar characteristics with the subject property. The appraiser must consider if the comparable is similar to the subject in terms of quality, location, investment grade, and occupancy.

The date of sale of a comparable must be considered, in case conditions related to income rates and supply and demand may have changed. Since market derivation is partially a sales analysis, financing terms and conditions of sale should also be considered. Additionally, it is important that the income sources for the comparables be considered. The appraiser should analyze if the leases are at market rates, as well as the credit quality of the current tenants. Another important consideration is the type of buyer. Different types of buyers may have different expectations in regards to return requirements. For example, a real estate investment trust may have different requirements than and institutional buyer. When these factors have been fully considered and similar comparables can be produced, the market derivation rate is very reliable and the other methods can be used as a check. When market extracted capitalization rates are not available, the appraiser can turn to the other methods to produce a capitalization rate. In the final part of this series we will take a look at the factors that must be considered in the reconciliation of a capitalization rate.